Community Investment Funds: Five Models That Keep It Simple

For a number of years, our team at PathLight Law has been helping clients design and build community investment funds, or CIFs. We believe CIFs are the key to democratizing our economy because they can provide an opportunity for anyone of any means to invest in their own community and thereby build enduring wealth, while also channeling much-needed capital to the kind of local ventures that each community actually wants.

Our vision is that every community in America will have at least one local-based CIF that anyone can invest in, and ideally several. The strategies to do so are available right now. So why aren’t there thousands of CIFs popping up in communities everywhere? We’ve spoken with many people around the country about CIFs; and while there’s a lot of enthusiasm around CIFs, it seems that the number one barrier to building these funds is the common perception that CIFs are complicated, expensive to set up, and risky.

But CIFs don’t have to be complicated, expensive or risky. Yes, the laws that govern CIFs can be complex, and CIF strategies aren’t well-known. But once a compliance strategy is selected, executing on that strategy doesn’t need to be complicated. It also doesn’t need to be expensive, since in most cases there is no regulatory filing needed to comply with the chosen fund strategy, and there is usually nothing unusual about the way an entity needs to be set up or how it raises capital. (Note that a chosen capital-raising strategy may require a regulatory filing, but that’s a different topic.)

As to the question of risk, there is always some risk when you’re taking in investment and dealing with securities laws. But there is nothing unusually risky about CIFs – compared to, say, a private fund. The perceived risks with CIFs are more attributable to unfamiliarity with the strategies than to any intrinsic risks in the development and management of a CIF.

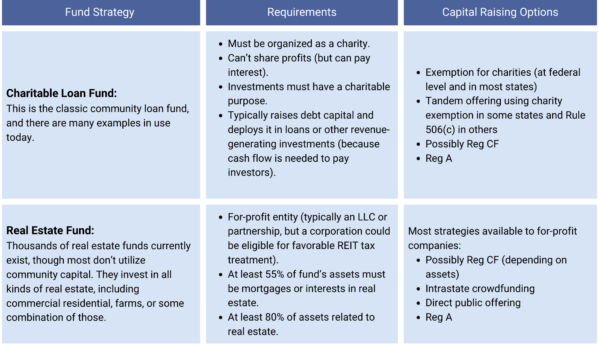

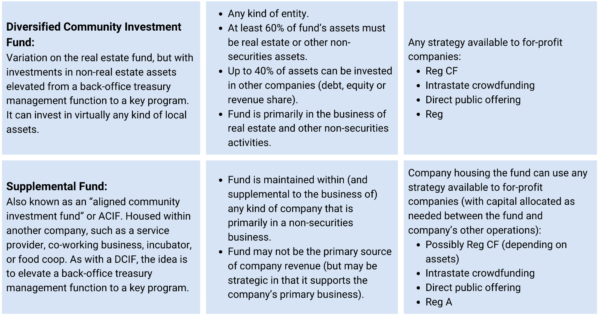

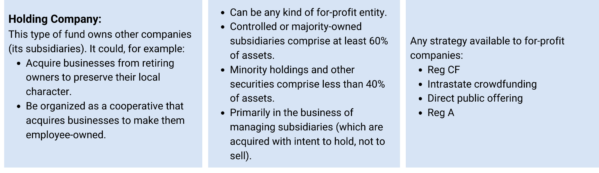

There are some fairly simple strategies for setting up a CIF that can be done efficiently and cost-effectively at a community scale. In the table below, I briefly outline five strategies (or compliance “models”) that may be particularly useful. (For others, see Chapter 3 of this free handbook on CIFs that I co-authored with some of my colleagues at NC3.) All of the funds described below can choose to raise capital publicly and can take investment from both accredited and non-accredited investors. Any of them can raise debt capital (i.e. issue investment notes to investors); and any of them except for the charitable loan fund can alternatively raise equity capital (i.e. with investors becoming co-owners of the fund) and then distribute profits to those equity investors.

Note that I won’t discuss capital-raising strategies in detail, other than to note some of the strategies that are available under each model. To read about capital-raising strategies, start here.

Naturally, this summary of CIF strategies is offered for informational purposes only and should not be taken as legal or investment advice. There are nuances to all of these strategies; and while those nuances won’t necessarily make the fund complicated, expensive or risky, it is essential to have good legal guidance before you go down any of these paths.

Contact us to learn more about community investment fund strategies for your organization.